Historically, the residential property market has been very kind to Australian investors and owner-occupiers alike.

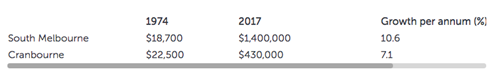

In the past there was less of a need for careful research because to a certain extent, the return on buying or investing in property was quite lucrative. Yet this table showing the price growth in two different Melbourne locations over the last 40 years helps explain why some areas achieve much better price growth than others:

Both South Melbourne (3kms from the CBD) and Cranbourne (43kms from the CBD) have performed well since 1974.

But as you can see, an investor who chose to buy in South Melbourne 40 years ago is three times better off today.

This is why it’s vital to understand lifestyle drivers and the psychology of what the market wants.

What determines property prices?

Housing is a basic need, and most people want to live in their dream home. Therefore, property is an emotional asset class.

There are three main factors which drive market demand and therefore prices:

1. Economic Activity: People move to cities where they can access job opportunities and earn good money.

2. Human Interest: What can I do in this suburb on the weekend?

3. Human Behaviour: What will people think of me, if I live here?

Owner-occupiers will pay a premium (if they can afford to), to get what they want – the water views, the proximity to work, the art deco features, the status of the location, lifestyle conveniences – restaurants, cafes, dog parks etc.

These lifestyle drivers are the direct cause of some markets outperforming others.

As a result, market growth has become more differential, in that, some localities perform beautifully and others stagnate or decline.

Our job as investors is to get behind that and study the human psychology of preference.

No longer can you simply put your name on a title and wait for time to do its work. You have to be more proactive and make better choices.

LOCATION, LOCATION!!

The only thing you can’t change about a property is its location.

As a good rule of thumb, when it comes to price growth the suburb does 80% of the heavy lifting, and the property itself does the remaining 20%.

Of course, we all aim to get both the location and the property right ever time.

Yet fundamentally, an ‘average’ property in a great location is preferable to a great property in an average location.

But a word of caution here – if you buy the wrong property, you will undo all the good work you’ve done in choosing the right location.

MOST investors get this wrong and look at the property first before the area.

You should consider the characteristics or features of a property you wish to invest in or buy in the following order:

1. State

2. Suburb (ideally within 10-12km of a capital city)

3. Street (position and performance)

4. Property (detailed analysis)

5. Due Diligence (building inspection, title type)

6. Negotiation

PROPERTY TYPE

Once you have determined the right location, the property type comes next.

While houses, townhouses and units can all make good investments, it’s important you know which property type is right for the people living in that particular area.

Research the demographics – age, incomes, professions, family sizes etc. If it is largely a family area, they will want houses rather than units. Whereas, if it’s a fashionable area full of young professionals and uni students, a 70s style low-density unit is likely to do very well.

With the right research and team of professionals behind you, a lot of the guesswork and risk of investing can be eliminated, resulting in an excellent investment that outperforms the market.

ARTICLE CREDIT: The Property Couch @ www.realestate.com.au © 2017

You can see the original article here